The global economy is currently influenced by various factors, including the decline in oil prices, the rise of Asian stock markets, and the increased difficulty of Bitcoin mining. Below is a detailed analysis of how these elements impact the global economy and its future outlook.

1. Decline in Oil Prices and the Potential for a Soft Landing

Causes and Effects of Oil Price Decline

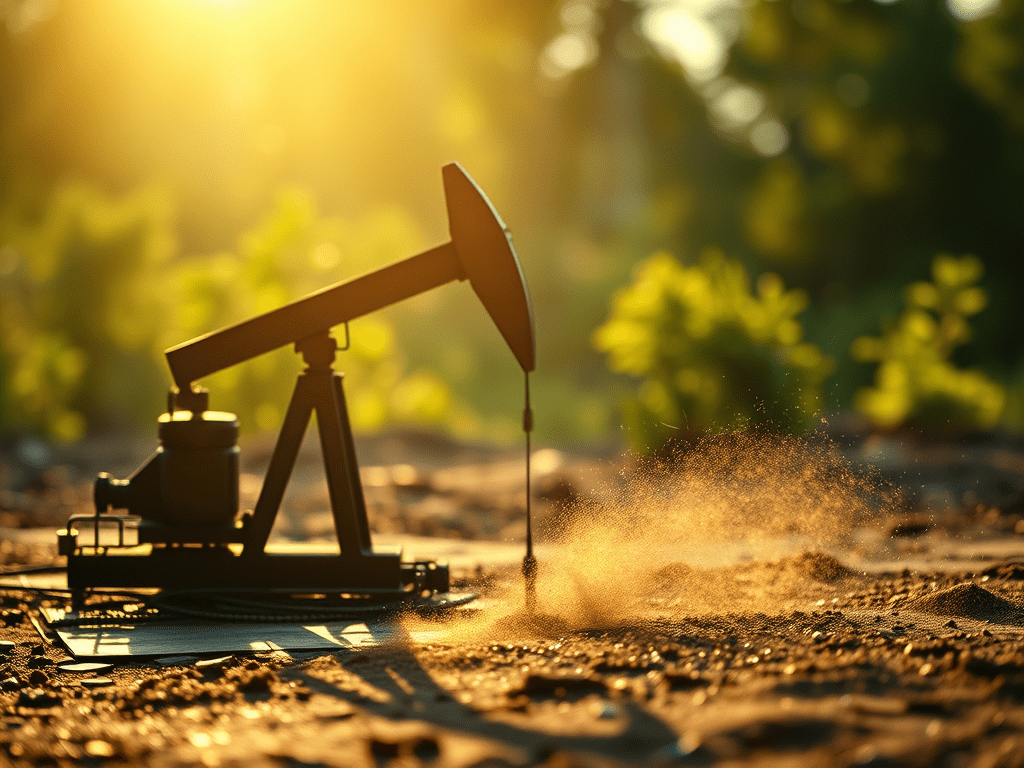

International oil prices have recently dropped to the $60-per-barrel range due to weakened global demand, deflation concerns in China, and the impact of trade wars. In general, lower oil prices reduce costs for consumers and businesses, which can positively impact economic growth. According to the International Energy Agency, a 10% drop in oil prices can improve global GDP growth by approximately 0.1%.

Possibility of a Soft Landing

If oil prices remain low, inflationary pressures may ease, allowing central banks to adopt a more moderate stance on interest rate hikes. This could enable a “soft landing” scenario, where the economy slows down without slipping into recession. For example, the U.S. Federal Reserve could slow the pace of rate hikes in a low-inflation environment, reducing the risk of a recession.

2. Rising Asian Stock Markets and Technology Stocks

The Impact of Technology Stocks, Especially NVIDIA

Recent gains in technology stocks like NVIDIA have positively influenced the broader Asian stock markets, signaling increased demand for technological innovation and the AI sector. Gartner Research estimates that spending on AI and data analytics could grow by 20% annually through 2025, which strengthens investor confidence

This illustration is a visual representation of recent gains in tech stocks like NVIDIA having a positive impact on the Asian stock market. It also includes expectations of increased investment in the AI sector and data analytics, which also shows strengthening investor confidence in tech stocks.

Sign of Recovery in Market Confidence

The rise in Asian stock markets suggests a short-term recovery in investor confidence. Specifically, Japan’s Nikkei 225 index has seen a rebound of over 5%, driven by gains in technology stocks, reflecting broader optimism for global economic recovery.

3. Increasing Bitcoin Mining Difficulty and Cryptocurrency Market Uncertainty

Impact of Rising Bitcoin Mining Difficulty

Bitcoin mining difficulty has reached record highs, indicating increased competition within the cryptocurrency market. As mining profitability decreases, companies like Riot Blockchain have seen stock prices drop by over 30% this year, highlighting the challenges faced by industry players.

Uncertainty in the Cryptocurrency Market

The high volatility of the cryptocurrency market poses risks to the global financial system. Many major institutional investors are reducing their exposure to cryptocurrencies or enhancing their hedging strategies, which could limit the market’s liquidity. For example, prominent U.S. banks are taking a cautious approach to crypto-related assets, reflecting the need for stability.

4. Overall Outlook

Positive Factors

The decline in international oil prices may help ease inflationary pressures, increasing the possibility of a soft landing for the economy. Additionally, the strength in Asian tech stocks signals sustained growth driven by innovation.

This illustration shows the impact of declining international oil prices helping to ease inflationary pressures, potentially leading to a soft landing for the economy. It also highlights the sustained growth driven by innovation in Asian tech stocks.

Negative Factors

Concerns about deflation in China, ongoing trade wars, and other global economic risks remain significant. The rise in Bitcoin mining difficulty further adds to the uncertainties in the cryptocurrency market, which could affect broader financial markets.

Conclusion: Cautious Optimism and the Need for Ongoing Monitoring

The global economy is currently in a phase where positive and negative factors are closely interacting. While cautious optimism may prevail in the short term due to the decline in oil prices and the strength of Asian stock markets, medium- to long-term prospects will depend largely on government policy responses and the unfolding of various global risk factors.

As such, the future economic outlook will rely heavily on key economic indicators, policy changes, and trends in global markets, including oil, interest rates, and cryptocurrency.

Leave a comment