Wealth

-

The Hidden Dangers of Overconsumption and Lack of Planning

In today’s fast-paced world, the allure of instant gratification tempts many into the habit of overconsumption. Whether it’s shopping for the latest gadgets, indulging in luxurious dining, or even binge-watching our favorite shows, the lack of mindful consumption can lead to significant risks. This blog post will explore the dangers…

-

The Benefits and Challenges of Remote Work in 2023

1. The Rise of Remote Work and Freelancing Shifting Work Models The digital age has transformed how people work, enabling flexibility and freedom that traditional office-based jobs couldn’t offer. With the rise of high-speed internet and cloud technology, working from anywhere has become more feasible than ever. Companies are increasingly…

-

The Importance of an Emergency Fund

Why Do You Need an Emergency Fund? “Do I really need an emergency fund?” This is a question many people ask. The answer is simple: Yes, you do! An emergency fund serves as your financial safety net during unexpected situations such as job loss, sudden medical expenses, or car repairs.…

-

Smart Financial Products for Emergency Savings: Secure Your Safety Net

Introduction: Why Do You Need Emergency Savings? Life is full of surprises—both pleasant and not-so-pleasant. Unexpected medical bills, sudden unemployment, or urgent family matters can arise at any moment. This is why having an emergency fund is essential. It’s more than just extra cash; it’s your financial shield against life’s…

-

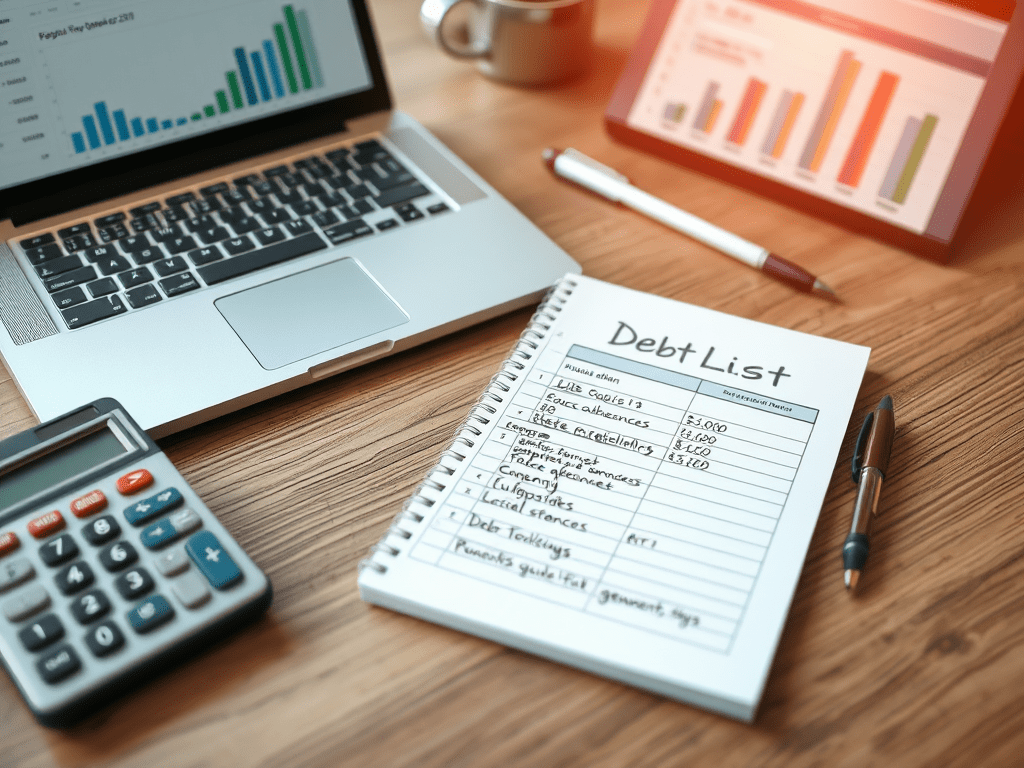

Debt Repayment Plan: Step-by-Step Guide and Success Strategies

1. What Is a Debt Repayment Plan? A debt repayment plan is a systematic strategy for organizing and gradually paying off your debts. It goes beyond simply paying off balances; it is the foundation for achieving financial stability and future financial goals. Summary:A debt repayment plan uses structured analysis and…

-

Why You Need an Emergency Fund and How to Build One

1. What Is an Emergency Fund? An emergency fund is a financial safety net set aside for unexpected expenses or emergencies, such as medical bills, job loss, or urgent home repairs. Often referred to as a “Rainy Day Fund,” it ensures you have the resources to handle unforeseen situations without…

-

The Importance of Debt Management: A Smart Financial Planning Guide

1. What is Debt Management? Debt management involves systematically organizing and controlling your financial obligations to maintain financial stability. It’s not just about paying off debt but also achieving long-term financial goals. From mortgages to student loans and credit cards, debt is an integral part of modern life. Effective debt…

-

Effective Ways to Cut Unnecessary Expenses

Introduction: Why Is Financial Management So Important? Managing your finances isn’t just about saving money—it’s about creating stability, freedom, and opportunities. Whether it’s building an emergency fund, planning for a dream vacation, funding education, or preparing for retirement, having control over your spending is the key to achieving your goals.…

-

Post-Retirement Financial Management: Smart Strategies for Reducing Expenses

Managing your finances after retirement is essential not just for cutting costs but for designing a stable and enjoyable post-retirement life. This article explores practical financial management strategies backed by real-life examples to help you make informed decisions. We’ll also compare the pros and cons of various approaches and provide…

-

The Key to Successful Investing: Essential Strategies for Balancing Risk and Return

Risk and Return: Fundamental Concepts and Importance What is Risk? Risk refers to the possibility that an investment’s actual outcomes will differ from expectations. This includes the potential for loss of principal as well as returns falling short of expectations. Types of Risk For instance, investing in stocks carries market…