Planning for retirement is no longer optional—it’s essential. With increased life expectancy and ongoing economic uncertainty, personal pensions and retirement pensions have become indispensable tools for building a stable future. This article dives into the differences between the two, how to leverage them effectively, and provides actionable strategies to prepare for a financially secure retirement.

Understanding Personal and Retirement Pensions

1. What is a Personal Pension?

A personal pension is a retirement savings plan that individuals can set up independently. Contributions are made regularly, and the accumulated fund is withdrawn as a pension during retirement.

Key Features of Personal Pensions

- Tax Benefits: Annual contributions of up to $4,000 can be tax-deductible.

- Diverse Investment Options: Choose from safe savings accounts to higher-risk investments like funds and ETFs.

- Flexibility: Adjust contribution amounts and schedules according to your financial situation.

2. What is a Retirement Pension?

A retirement pension is a company-sponsored plan where employers contribute to the employee’s retirement fund. Employees can receive it as a lump sum or monthly pension after retirement.

Key Features of Retirement Pensions

- Legal Security: Funds are protected under law for safe management.

- Additional Contributions: Individuals can make extra contributions through IRAs.

- Tax Advantages: Lower tax rates (3-5%) when pensions are received in installments.

Strategies for Maximizing Personal Pensions

1. Make the Most of Tax Benefits

Contributions to personal pensions are eligible for tax deductions, providing significant savings, especially for higher-income individuals.

Example

- Contributing $4,000 annually with a 13% tax deduction rate saves $520 in taxes.

- For those in higher tax brackets (16.5%), the savings increase to $660.

2. Choose Investment Products Wisely

From savings accounts to equity-based funds, personal pensions offer various investment options. Selecting the right one can significantly impact returns.

Recommended Strategies

- Aggressive Approach for Younger Investors: Opt for equity funds or ETFs to maximize returns.

- Stable Investments for Those Near Retirement: Shift to low-risk, secure products like fixed deposits.

3. Automate Contributions

Set up automatic monthly contributions to ensure consistent savings. Even small amounts, when invested regularly, grow significantly over time due to the power of compounding.

Strategies for Maximizing Retirement Pensions

1. Leverage IRAs for Additional Savings

Individual Retirement Accounts (IRAs) allow employees to make additional contributions to their retirement pension.

Advantages of IRAs

- Annual contributions of up to $7,000 are allowed, with $4,000 eligible for tax deductions when combined with personal pensions.

- Extra savings boost retirement funds significantly.

Tax Savings

- Contributing $7,000 annually can save approximately $1,150 in taxes.

2. Diversify Your Portfolio

Retirement pensions allow investments in various asset classes such as stocks, bonds, and savings accounts. A diversified portfolio minimizes risks and maximizes returns.

Recommended Portfolio Allocation

- 50% Bonds: Ensures stability.

- 30% Stocks: Provides long-term growth potential.

- 20% Savings: Maintains liquidity and guarantees principal.

3. Opt for Pensions Over Lump-Sum Payments

Receiving your retirement fund as a monthly pension instead of a lump sum can be more tax-efficient.

Comparison

- Lump-Sum Payment: Subject to a 20% tax rate.

- Monthly Pension: Tax rates range from 3% to 5%, significantly reducing the overall tax burden.

Why Combine Personal and Retirement Pensions?

1. Ensures a Stable Retirement Income

Personal pensions are self-managed, while retirement pensions are employer-supported. Using both provides a more diversified and secure income stream during retirement.

2. Maximizes Tax Benefits

Together, personal and retirement pensions allow up to $7,000 in annual contributions with substantial tax deductions.

3. Balances Risk and Returns

Retirement pensions prioritize stability, while personal pensions focus on higher returns. Combining these approaches balances risk and maximizes growth.

Actionable Tips for Retirement Planning

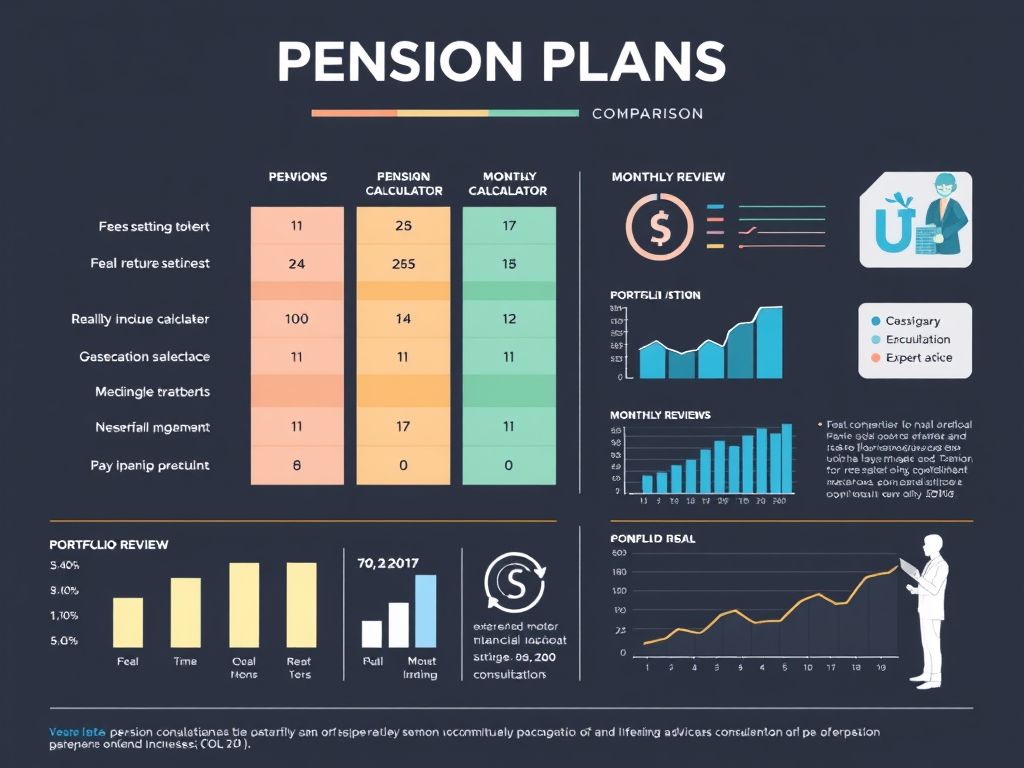

- Compare Pension Plans: Research various providers to compare fees, returns, and tax benefits.

- Set Clear Goals: Calculate the monthly income needed during retirement and align your contributions accordingly.

- Review Your Portfolio Regularly: Adjust your investment mix based on market trends and your life stage.

- Consult a Financial Advisor: Get expert advice to choose the most suitable pension plans and strategies.

Conclusion: Start Preparing Today for a Secure Future

Retirement planning is a journey that benefits from an early start. By effectively utilizing personal pensions and retirement pensions, you can secure substantial tax savings and build a robust financial foundation for your golden years. The decisions you make today will shape your financial freedom tomorrow. Start small, stay consistent, and watch your efforts pay off in a worry-free retirement.

Please don’t forget to leave a review.

Leave a comment