What is Compound Interest?

The Difference Between Compound and Simple Interest

Compound interest refers to earning interest not only on your initial principal but also on the accumulated interest from previous periods. In contrast, simple interest is calculated only on the principal. While the difference may seem minor over a short term, compound interest significantly boosts wealth over time.

Example: Simple vs. Compound Interest Comparison

| Type | Principal | Annual Interest Rate | Duration (Years) | Final Amount |

|---|---|---|---|---|

| Simple | $10,000 | 5% | 10 | $15,000 |

| Compound | $10,000 | 5% | 10 | $16,288 |

The longer the duration, the more evident the advantage of compound interest becomes.

Key Elements of Compound Interest

- Time: The longer your savings are invested, the greater the effect of compounding.

- Rate of Return: Higher interest rates magnify the benefits of compounding.

- Consistency: Regular contributions are essential to fully leverage compound growth.

Why Compound Interest is Crucial for Long-Term Savings

The Power of Time: The Relationship Between Compound Interest and Savings

Time is the most critical factor for compound interest. As your savings grow, the interest earned increases exponentially. This means that the earlier you start, the more significant the benefits.

The Impact of Early Savings on Wealth Growth

Starting early provides a huge advantage. For instance, someone who starts saving at age 25 with monthly contributions of $200 will accumulate significantly more than someone who starts at 35, even if the latter contributes the same amount.

Case Study: The Effect of Starting Early

| Starting Age | Monthly Contribution | Duration (Years) | Final Amount |

|---|---|---|---|

| 25 | $200 | 30 | ~$120,000 |

| 35 | $200 | 20 | ~$72,000 |

The difference is clear: starting early leads to nearly double the final amount.

Strategies to Maximize Compound Interest

Comparing and Choosing Financial Products

Selecting the right financial product is essential to maximize compound interest:

- Savings Accounts: Ideal for safety but offer modest returns.

- Mutual Funds: Higher potential returns, suitable for long-term goals.

- Retirement Accounts: Combine tax benefits with compounding for exponential growth.

Building Consistent Saving Habits

Consistency is key. Set up automated contributions to ensure regular savings without disruptions.

Combining Compound Interest with Investment for Maximum Returns

- ETFs and Index Funds: Provide diversification and long-term growth.

- Dividend Reinvestment Plans (DRIPs): Reinforce compounding by reinvesting dividends.

Success Stories Utilizing Compound Interest

Real-Life Case Studies of Early Investment

Consider Sarah, who starts investing $300 monthly at age 22 in a fund with a 7% annual return. By age 52, her investment grows to over $360,000. Meanwhile, John, who begins at 32, only accumulates $170,000 by the same age, despite contributing the same amount monthly.

Merging Compound Interest with Retirement Accounts

Retirement accounts like 401(k)s or IRAs allow you to combine tax advantages with compounding, amplifying your savings significantly.

The Pros and Cons of Compound Savings and How to Overcome Challenges

Advantages: Accelerated Wealth Growth Over Time

- Exponential increase in savings as time progresses.

- A reliable method to build wealth for retirement or other goals.

- Low maintenance once the system is established.

Overcoming the Slow Start of Compound Interest

Compound interest takes time to show results, especially in the early stages. Here’s how to stay motivated:

- Start Small, Stay Consistent: Even modest savings grow substantially over time.

- Choose High-Yield Accounts: Seek accounts with competitive interest rates.

- Focus on Long-Term Goals: Shift your perspective to long-term wealth building.

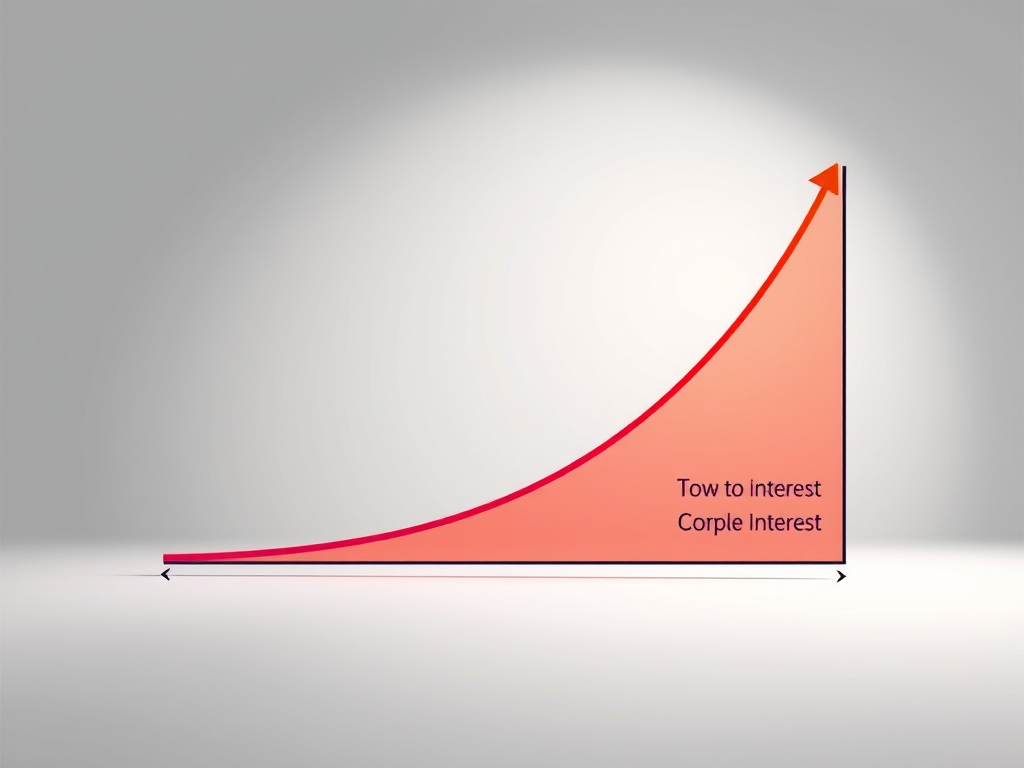

Visual Aids to Simplify the Concept of Compound Interest

Growth Over Time: Compound vs. Simple Interest Graphs

A visual representation can make the exponential nature of compound interest easier to grasp.

- Compound Interest: A curve showing accelerated growth over time.

- Simple Interest: A straight line indicating slower, steady growth.

Example Comparison Table: Compound vs. Simple Interest

| Scenario | Principal | Interest Rate | Years | Simple Interest | Compound Interest |

|---|---|---|---|---|---|

| Case A | $10,000 | 5% | 10 | $15,000 | $16,288 |

| Case B | $10,000 | 5% | 20 | $20,000 | $26,533 |

Conclusion and Actionable Advice

Compound interest is a game-changer for anyone seeking to grow their wealth. By starting early, saving consistently, and choosing the right financial products, you can harness the power of compounding to achieve your financial goals. Remember, the best time to start was yesterday—the next best time is today. Take the first step toward securing your financial future now.

Leave a comment