Achieving financial freedom and building wealth isn’t something that happens overnight—it requires a clear plan, consistent effort, and a commitment to learning along the way. While the idea of becoming wealthy may seem daunting, breaking it down into manageable steps makes the journey more achievable. In this guide, I will share a roadmap to wealth, focusing on setting clear financial goals, managing assets, making smart investments, and continuously improving your financial education. Along the way, I’ll include personal anecdotes, practical templates, and resources to help make these concepts more relatable and actionable.

1. Setting Clear Goals: Your Personal Wealth Destination

The first step to becoming wealthy is to set clear, actionable goals. Many people set vague financial goals like “I want to be rich” or “I want to save more,” but without a specific target, it’s easy to lose direction. One of my personal experiences illustrates this: In my early twenties, I had a general idea that I wanted to be financially independent, but I didn’t know how much money I needed or how to get there. It wasn’t until I set a specific goal of saving $50,000 by the time I turned 30 that I began to see progress.

To make your goals more achievable, follow the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of saying, “I want to save more money,” set a goal like, “I will save $1,000 each month for the next five years to build an emergency fund.”

Take a moment to reflect: What specific financial goal do you have? Is it paying off debt, saving for a house, or accumulating a certain amount of wealth? Share your thoughts in the comments or write them down to start creating your personal wealth roadmap.

This images set clear financial goals, follow SMART principles, and represent a roadmap to becoming rich. Each milestone represents a specific goal setting, and the background includes symbols for financial independence and success.

2. Assessing Your Current Financial Status: A Reality Check

Before you can start building wealth, it’s essential to assess your current financial situation. This step often feels uncomfortable, especially if you haven’t paid much attention to your finances in the past. But I can assure you from personal experience, it’s eye-opening and empowering. I used to avoid checking my bank balance, fearing that ignorance would protect me from financial stress. But once I sat down and analyzed my income, expenses, and debts, I was finally able to take control of my finances.

To make this process easier, try using budgeting apps like Mint, YNAB (You Need a Budget), or even a simple Excel spreadsheet. These tools can help you track your income, categorize your expenses, and highlight areas where you can cut back. Here’s a simple template you can use:

| Category | Monthly Income | Monthly Expenses | Target Savings |

|---|---|---|---|

| Salary | $4,000 | ||

| Rent | $1,200 | ||

| Utilities | $200 | ||

| Groceries | $400 | ||

| Entertainment | $300 | ||

| Subscriptions | $50 | ||

| Savings | $1,000 |

This budgeting framework allows you to quickly see where your money is going and how much you can save each month. Reflect on your own financial habits: Are there areas where you can cut back to increase savings? Share your insights in the comments, and let’s start a conversation about ways to improve budgeting.

3. Building an Emergency Fund: Your Financial Safety Net

One of the most critical, yet often overlooked, steps in building wealth is establishing an emergency fund. This is a pool of money set aside for unforeseen expenses like medical bills, car repairs, or job loss. Financial experts typically recommend having three to six months’ worth of living expenses saved up.

I remember when I first started saving for an emergency fund, it felt like an overwhelming task. I was a recent graduate with student loans and a modest salary, so putting aside a large sum seemed impossible. But I started small—saving just $50 a week—and over time, my emergency fund grew to cover six months of expenses. This gave me tremendous peace of mind, knowing that I wouldn’t need to go into debt for unexpected costs.

Consider starting with a goal to save $500, then gradually increase it as you get more comfortable with saving. How much do you think you need in your emergency fund? Feel free to share your thoughts and strategies below.

4. Investing: Making Your Money Work for You

Once you’ve set your goals and built an emergency fund, it’s time to start investing. This is where your money really begins to grow. When I first entered the world of investing, I was intimidated by all the jargon—stocks, bonds, ETFs, mutual funds. But the more I learned, the more confident I became in making investment decisions.

If you’re new to investing, a great place to start is with index funds or ETFs. These are low-cost, diversified investments that track the performance of a broad market index, like the S&P 500. Index funds are less risky than picking individual stocks and offer a solid return over the long term. For example, the S&P 500 has historically returned an average of 7-10% annually over time.

One lesson I learned early on is to invest regularly, regardless of market conditions. This strategy, known as dollar-cost averaging, helps reduce the risk of market volatility. For instance, I set up an automatic investment plan that transfers $500 into an index fund every month. By doing this consistently, I can take advantage of market ups and downs without trying to time the market.

What’s stopping you from investing? Is it fear, lack of knowledge, or something else? Share your challenges, and let’s discuss how to overcome them together.

5. Continuous Learning: The Key to Long-Term Success

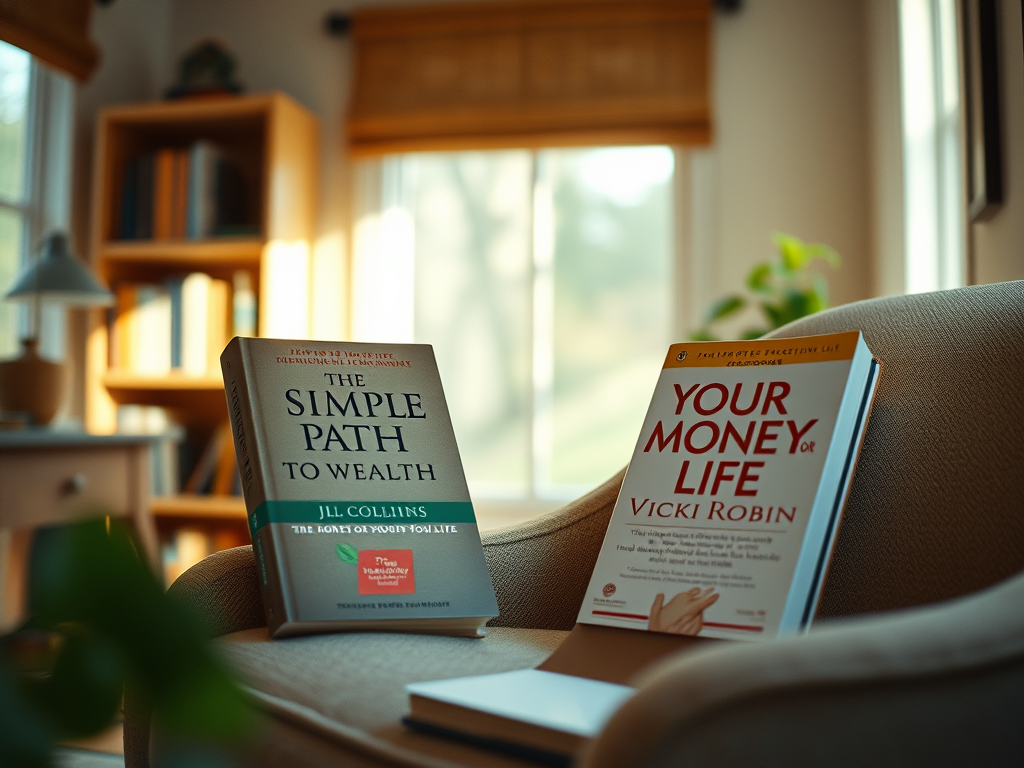

Building wealth isn’t just about saving and investing—it’s about financial education. The more you know, the better decisions you can make. Early in my financial journey, I started reading books like “The Millionaire Next Door” and “Rich Dad Poor Dad”. These books opened my eyes to the mindset and habits of wealthy individuals.

If you’re looking for resources to expand your financial knowledge, here are a few that I highly recommend:

- Books: “The Simple Path to Wealth” by JL Collins, “Your Money or Your Life” by Vicki Robin.

- Podcasts: “The Dave Ramsey Show”, “BiggerPockets Money Podcast”.

- Courses: Consider taking free online courses on platforms like Coursera or Khan Academy to learn about investing, budgeting, or personal finance management.

Investing in your financial education is one of the best decisions you can make. Ask yourself: What’s the last financial book or resource you explored? If you haven’t started yet, choose one from the list above and share your thoughts in the comments.

6. Reflect and Adjust: Your Plan is a Living Document

Finally, it’s important to remember that your financial roadmap is a living document. Life changes—whether it’s a new job, a marriage, or an unexpected event—can all impact your financial plan. That’s why it’s essential to revisit your goals, budget, and investment strategies regularly.

Personally, I review my financial situation every quarter to ensure I’m on track. I also make adjustments based on any significant life changes. For example, after getting married, my spouse and I combined our finances and reevaluated our savings and investment goals to align with our new family goals.

How often do you check your finances? Make a habit of reviewing your budget and investments regularly, and don’t be afraid to make adjustments as your life and goals evolve.

Conclusion: Take Action and Stay Committed

Building wealth requires patience, discipline, and continuous learning. By setting clear goals, managing your money wisely, investing smartly, and educating yourself, you can create a solid roadmap to financial success. The journey might not always be easy, but with a well-thought-out plan, anyone can achieve their financial dreams.

I encourage you to start today by setting your first financial goal or creating a budget. Share your progress and questions below—let’s build a community where we can learn and grow together on the path to wealth.

Leave a comment