Cryptocurrency is an exciting and dynamic field that has captured the attention of investors worldwide. This guide aims to demystify the complexities of cryptocurrency for beginners, making it accessible and engaging. By breaking down the basics, we’ll help you understand how to get started, manage risks, and potentially benefit from investing in digital currencies.

1. Understanding Cryptocurrency

- What is Cryptocurrency? Cryptocurrency is digital or virtual currency that uses cryptography for security. Unlike traditional currencies, it is decentralized and typically based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

- How Does Cryptocurrency Work? Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. This technology helps prevent fraud and provides a high level of transparency for transactions.

2. Starting with Cryptocurrency

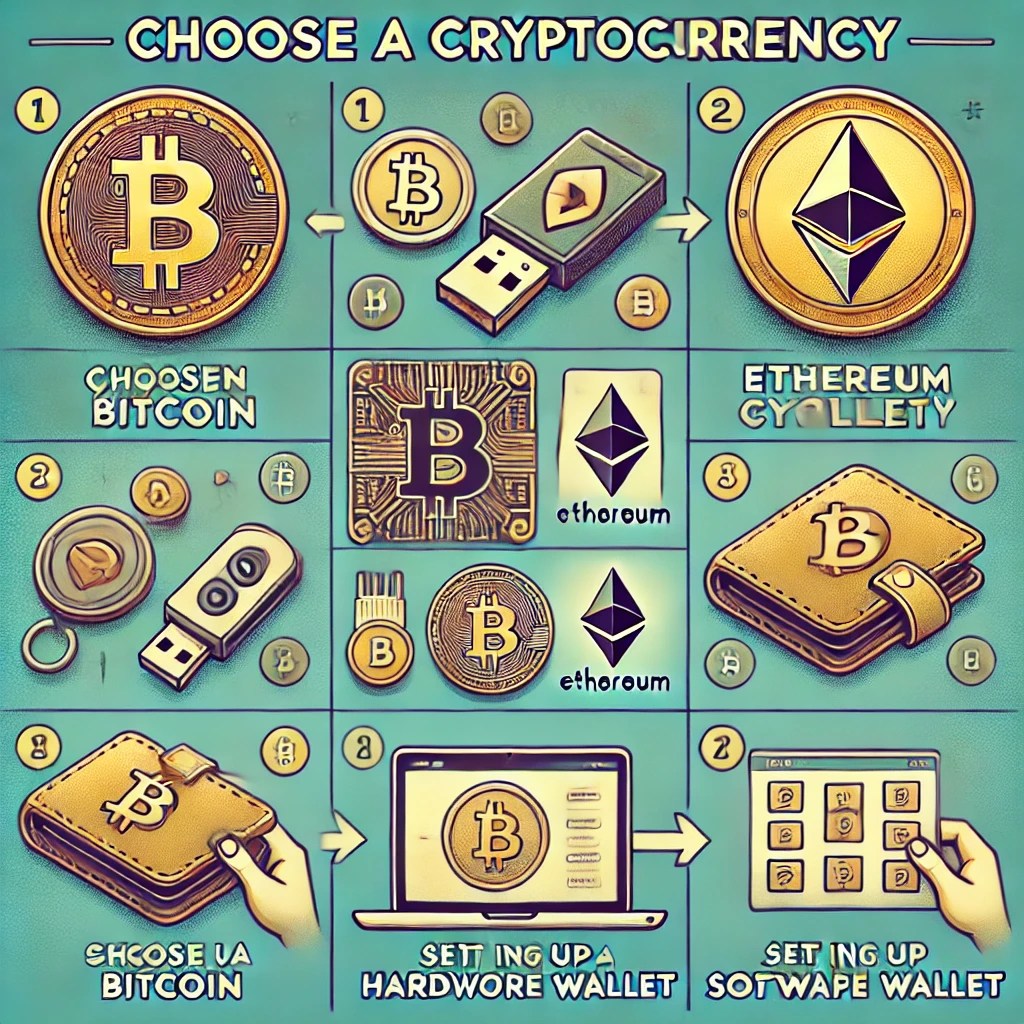

- Choosing a Cryptocurrency Bitcoin and Ethereum are the most well-known, but there are thousands of cryptocurrencies. Each has different technologies, goals, and volatility levels.

- Setting Up a Wallet To store and use cryptocurrencies, you need a digital wallet. Wallets can be hardware-based or software-based, each with its own security features and conveniences.

Here is the illustration depicting two key aspects of getting started with cryptocurrencies:

3. Investing in Cryptocurrency

- Research is Key Before investing, understand the market trends, the technology behind cryptocurrencies, and the risks associated with digital currency investments.

- Buying Cryptocurrency You can buy cryptocurrencies through exchanges, direct purchases, or even ATMs. Each method involves different processes and fees.

4. Managing Investment Risks

- Volatility Cryptocurrencies are known for their price swings. Investors need to be prepared for the possibility of losing a significant portion of their investment.

- Security Measures Implement strong security practices such as using secure networks, enabling two-factor authentication, and using a hardware wallet for significant amounts of cryptocurrencies.

5. Diversifying Your Portfolio

- Spread the Risk Like with traditional investments, it’s wise not to put all your eggs in one basket. Diversifying your crypto investments can help manage risk and increase potential returns.

6. Legal and Regulatory Considerations

- Stay Informed The legal landscape for cryptocurrency is constantly evolving. Understanding your local regulations and the tax implications of cryptocurrency investments is crucial.

Here is the illustration depicting the importance of staying informed about the evolving legal landscape of cryptocurrency. It shows a modern office setting where a character is surrounded by multiple digital screens. These screens display various legal documents, international flags, and cryptocurrency symbols like Bitcoin and Ethereum, highlighting the need to monitor changes in regulations actively. This scene is designed to convey the complexity and global nature of cryptocurrency regulations in a clear and visually engaging way.

7. Long-term Strategy

- Here is the illustration depicting the concepts of HODLing versus Trading in cryptocurrency:

- On one side, there’s a serene figure holding a large, secure safe or treasure chest labeled ‘HODL’, filled with various cryptocurrency coins, symbolizing long-term investment.

- On the other side, a dynamic scene shows a character actively trading on multiple screens with fluctuating cryptocurrency market graphs, labeled ‘Trading’.

- This visual uses contrasting colors to emphasize the calm of HODLing versus the high energy of trading, with a modern and clear style that highlights both investment strategies.

- HODLing vs. Trading Some investors hold on to their investments with the hope that their value will increase over the long term, a strategy known colloquially as “HODLing.” Others trade cryptocurrencies frequently to capitalize on market fluctuations.

- Conclusion Investing in cryptocurrency can be interesting and rewarding, but at the same time, it also comes with challenges. You can navigate the cryptocurrency world more safely and effectively by educating yourself, using the right tools, and executing careful investment strategies. Like all investments, cryptocurrency investments are highly price-varying, which risks losing a significant portion of your investment. In addition, they can be exposed to security threats such as hacking or fraud, and uncertainties in the legal and regulatory environment must be considered. Therefore, it requires thorough research and a careful approach.

Leave a comment