Managing personal finances can seem overwhelming for many young adults, especially as they transition into financial independence. In the U.S., where student loan debt, budgeting, and saving for the future are significant concerns, understanding how to manage money effectively is critical. This post will explore practical ways to manage student loans, create a budget, and develop saving strategies to help young adults take control of their financial future.

1. Managing Student Loans: Tackling Debt Strategically

Student loans are a major financial burden for many young adults in the U.S. The key to managing them effectively is to approach repayment strategically. Here are some tips to make this process smoother:

Understand Your Loans

The first step in managing student debt is understanding the types of loans you have. Federal loans generally offer more flexible repayment options, while private loans may have stricter terms. Knowing the interest rates, repayment terms, and options for deferment or forbearance is crucial for creating a solid repayment plan.

Create a Repayment Plan

There are several repayment plans to choose from, especially with federal loans. Income-driven repayment plans (like IBR or REPAYE) adjust your monthly payments based on your income and family size, making them more manageable if you’re just starting out in your career. You can also look into loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), if you work in the public sector.

Consider Refinancing

Refinancing your student loans could help lower your interest rate, especially if you have private loans. This can save you money in the long term. However, refinancing federal loans with a private lender means losing federal protections like income-based repayment and loan forgiveness, so weigh your options carefully.

Make Extra Payments (When Possible)

If you have extra cash from a tax refund, side gig, or bonus, consider putting it toward your student loans. Making extra payments directly toward the principal can reduce the total interest you’ll pay over time, helping you pay off your loans faster.

2. Budgeting: A Roadmap for Your Financial Life

Creating a budget is one of the most powerful tools for managing your finances. It doesn’t just help you keep track of your spending—it helps you take control of your money and make informed decisions. Here’s how you can start budgeting effectively:

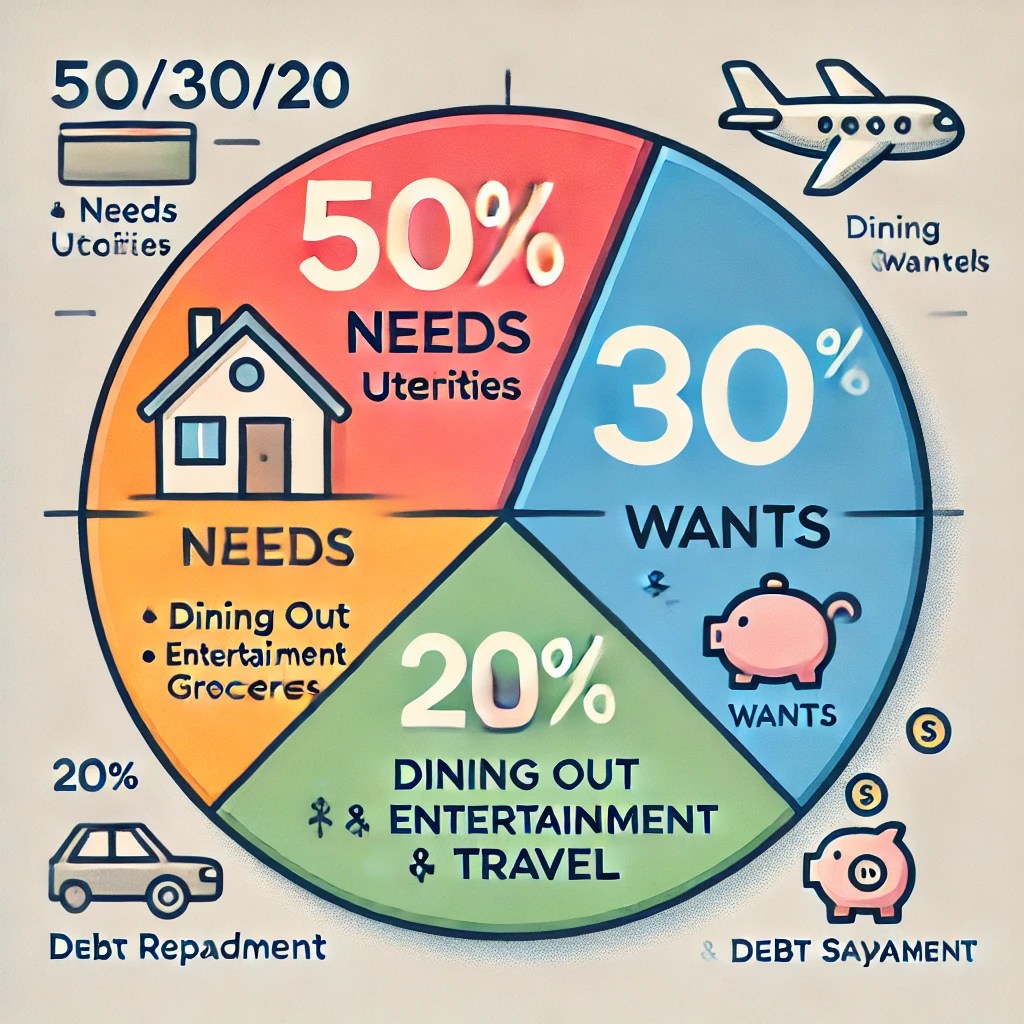

The 50/30/20 Rule

A popular and straightforward budgeting method is the 50/30/20 rule:

- 50% of your income goes toward needs (rent, utilities, groceries).

- 30% goes toward wants (dining out, entertainment, travel).

- 20% goes toward savings and debt repayment.

This formula helps you manage your spending while ensuring you’re saving for the future.

Track Your Expenses

Apps like Mint, YNAB (You Need a Budget), or PocketGuard can help you keep track of where your money is going. By categorizing your expenses, you’ll see where you might be overspending and where you can cut back. For instance, if you notice that your “wants” category is creeping up to 40%, it might be time to reconsider some of your discretionary spending.

Set Financial Goals

One of the most motivating aspects of budgeting is that it helps you achieve financial goals. These goals can range from building an emergency fund, saving for a big purchase, or paying off a credit card. Be sure to set both short-term (like paying off a small loan) and long-term (like buying a home) goals.

Automate Your Savings and Bills

Once you have a budget in place, automate your savings and bills to make sure you stay on track. Set up automatic transfers to a savings account and ensure bills are paid on time to avoid late fees. Automation makes sticking to your budget easier and less stressful.

3. Saving Strategies: Building Wealth from Day One

Building savings is essential for financial independence and future security. Even if you’re not earning a huge salary yet, it’s important to develop smart saving habits now.

Start an Emergency Fund

An emergency fund is your financial safety net. Experts recommend saving at least three to six months’ worth of living expenses in an easily accessible account. This fund will protect you from unexpected expenses, like medical bills or car repairs, without derailing your financial plans or forcing you into debt.

Take Advantage of Retirement Accounts

Saving for retirement might seem far off, but starting early can make a massive difference due to compound interest. If your employer offers a 401(k) with a company match, contribute at least enough to get the full match—it’s essentially free money. If your employer doesn’t offer a 401(k), consider opening an IRA (Individual Retirement Account) and contributing to it regularly.

Set Up Automatic Savings

Automatic savings transfers ensure that you’re regularly putting money away without having to think about it. Many banks allow you to set up an automatic transfer from your checking account to a savings or investment account each month. Even small amounts, like $50 a month, can add up over time.

Invest for Long-Term Growth

Once you have an emergency fund and have started saving for retirement, consider investing in stocks, bonds, or index funds to grow your wealth over time. Investing can help you build long-term financial security, but it’s important to educate yourself or consult a financial advisor to create a strategy that aligns with your goals and risk tolerance.

4. Developing Financial Discipline

Achieving financial independence is as much about mindset and habits as it is about the strategies you use. Here are some tips for building financial discipline:

Avoid Lifestyle Inflation

As your income grows, it can be tempting to spend more on luxury items, dining out, or expensive vacations. This is known as lifestyle inflation. To avoid this, try to maintain your spending levels even as you earn more. This will allow you to save and invest the extra income rather than spending it on things that don’t provide long-term value.

Learn to Live Below Your Means

Living below your means doesn’t mean depriving yourself of everything enjoyable. It simply means spending less than you earn and prioritizing needs over wants. This allows you to have more control over your finances and prepares you for unexpected expenses.

Stay Consistent

Consistency is key to financial success. Whether it’s sticking to your budget, paying down debt, or saving for the future, make sure you stay disciplined and consistent in your efforts. Financial independence is a marathon, not a sprint.

Conclusion: Taking Control of Your Financial Future

Managing your personal finances as a young adult may seem like a daunting task, but by developing strategies for student loan repayment, budgeting, and saving, you can take charge of your financial future. It’s about taking small, practical steps today that will set you up for success tomorrow. Start with a plan, stay disciplined, and you’ll soon find yourself on the path to financial independence.

By mastering these financial principles, you’ll be better prepared for life’s unexpected twists and turns, all while building the foundation for a secure and prosperous future.

Leave a comment