In today’s fast-paced world, managing finances wisely can feel like an ongoing challenge, yet it’s the key to long-term stability and peace of mind. Establishing a solid foundation in budgeting, saving, and investing can help anyone progress toward financial independence. This article will break down essential strategies and practical tips for building a stable financial future, whether you’re new to financial planning or looking to sharpen your skills.

1. Start with a Budget that Works for You

Creating a budget is the foundation of any financial plan. A good budget gives a clear picture of where your money is going, allowing you to make intentional decisions about spending and saving.

Choosing the Right Budgeting Tool: Look for budgeting tools that fit your lifestyle. For tech-savvy users, apps like Mint offer automation and detailed insights, while YNAB (You Need a Budget) uses a proactive approach, helping you allocate every dollar purposefully. If you prefer hands-on tracking, a simple spreadsheet might be more effective.

Example: If you earn $4,000 monthly and find that $600 goes toward entertainment, consider adjusting this to allocate more toward savings or debt repayment.

2. Build an Emergency Fund as Your Financial Safety Net

An emergency fund provides a buffer for unexpected expenses like medical bills or home repairs, helping you avoid debt. Aim to save 3-6 months’ worth of essential living expenses in a high-yield savings account.

Periodic Review: Circumstances change, so review your emergency fund periodically to ensure it meets your needs. Major life events like marriage, relocation, or a new job may require adjustments to keep your fund relevant.

Importance of an Emergency Fund: Without one, a sudden expense could disrupt your finances, forcing reliance on high-interest loans or credit cards. Having a cushion promotes peace of mind, knowing you can handle life’s surprises.

3. Pay Down Debt Strategically with a Method that Fits Your Needs

Debt is one of the greatest obstacles to financial freedom. Reducing high-interest debt, like credit card balances, should be a top priority.

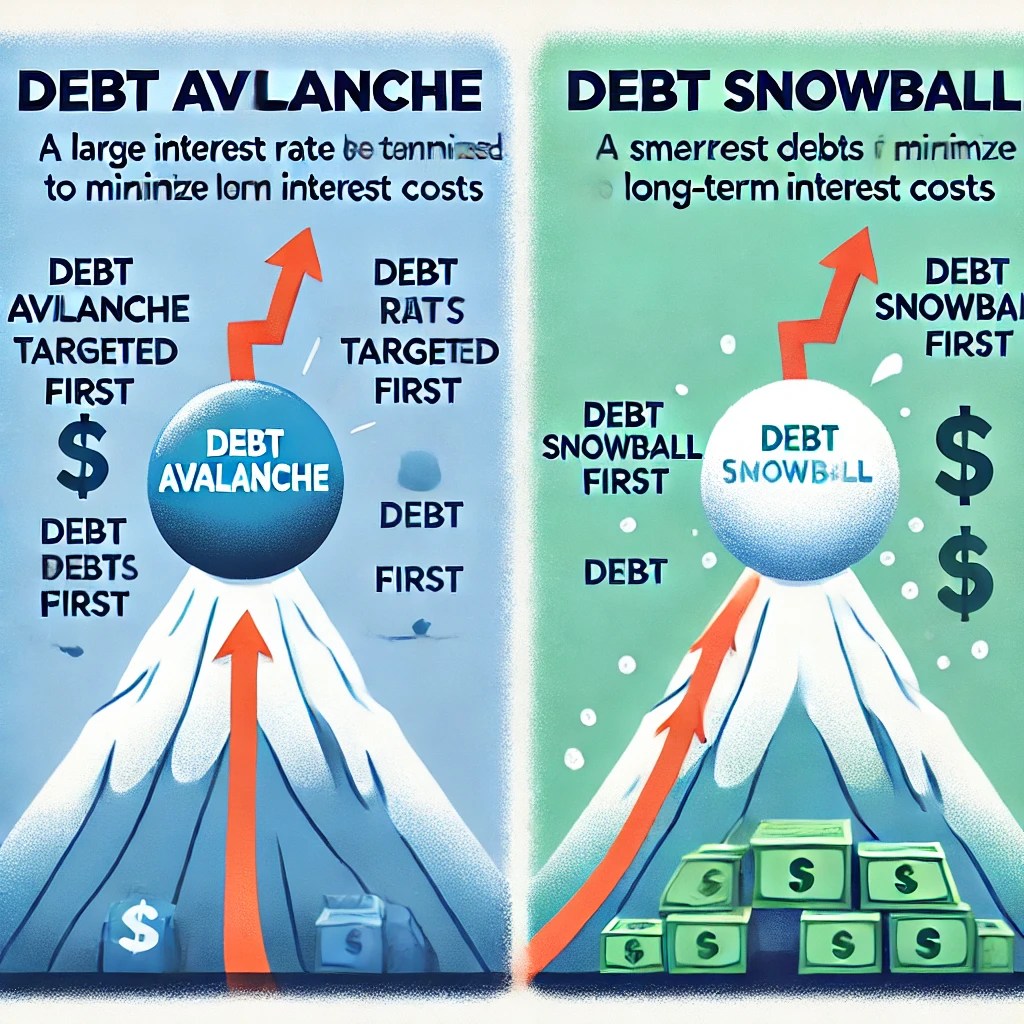

Choosing a Debt Repayment Strategy:

- Debt Avalanche: Pay off the highest interest rate debt first. This minimizes interest over time, though it may take longer to see results.

- Debt Snowball: Focus on smaller balances first to achieve early wins, creating motivation as you clear each debt.

An illustration comparing the debt repayment method ‘Debt Avalanche’ and ‘Debt Snowball’ methods

Example: Imagine you have $5,000 on a credit card with 20% interest and $2,000 on a loan with 10% interest. Using the Debt Avalanche, you’d tackle the credit card debt first, potentially saving hundreds in interest costs.

4. Save and Invest Consistently for Long-Term Growth

Setting aside money for savings and investments is crucial for wealth building. Start by automating transfers to a savings account and, if possible, an investment account each month.

Building a Diversified Portfolio: Diversifying your investments helps balance risk and return. A beginner-friendly mix might include a combination of:

- Stocks: For growth, albeit with higher risk

- Bonds: Lower-risk options that provide steady returns

- ETFs or Mutual Funds: Enable broad exposure to various sectors or industries

Practical Example: A balanced portfolio might allocate 50% to stocks, 30% to bonds, and 20% to ETFs focused on stable sectors like healthcare or technology. This diversification reduces risk while allowing room for growth.

5. Plan for Retirement Early and Enjoy the Power of Compound Interest

The earlier you start saving for retirement, the greater the benefits due to compound interest. Contributing to retirement accounts, such as RRSPs or TFSAs in Canada, is essential for long-term security.

Breaking Down Retirement Misconceptions: Many young people delay retirement saving, thinking it’s too early. In reality, a 25-year-old who invests $200 monthly with a 6% annual return can accumulate over $230,000 by age 65. Waiting until 35 nearly halves that amount, proving the power of starting early.

This illustration shows the difference between when young people start saving retirement early and when they start late. By comparing when they started at the age of 25 and when they started at the age of 35, we visually expressed how much impact starting saving early has.

Consider Using a Retirement Calculator: Tools like Vanguard’s retirement calculator can provide a personalized estimate, helping you understand how much you’ll need to save monthly based on your goals.

6. Monitor and Improve Your Credit Score Regularly

Your credit score is a crucial factor in determining your financial opportunities, as it can impact everything from loan approvals to interest rates. Understanding what constitutes a good score can help set realistic goals and encourage improvements over time. Here’s a quick breakdown:

- Good Credit Score Ranges: Generally, a score of 670 and above is considered good, while a score of 740 or higher is often viewed as excellent. Each country and credit bureau may have specific ranges, so check the standards in your area.

- Why It Matters: A higher score can lead to better terms on mortgages, car loans, and credit cards, helping you save money in the long run. Additionally, landlords and employers in some regions may use credit scores as part of background checks, which can influence your housing or employment prospects.

- Tips for Improvement:

- Pay bills on time to establish a consistent payment history.

- Keep credit card balances low relative to the credit limit.

- Avoid opening multiple new accounts at once, as this can negatively impact your score.

Lastly, use credit monitoring services or annual reports from bureaus to track your progress. By understanding and actively managing your credit score, you can unlock more favorable financial options and build a strong foundation for future growth.

7. Seek Professional Financial Advice for a Personalized Plan

While self-guided strategies are useful, sometimes it’s beneficial to consult a financial advisor, especially for long-term financial planning or complex situations.

Finding the Right Advisor: Look for certified professionals (like a CFP, Certified Financial Planner) who can offer tailored advice based on your specific financial goals. An advisor can help you create a tax-efficient plan, assess your risk tolerance, and manage investments in a way that aligns with your future goals.

Example: For young investors, an advisor might recommend a growth-focused portfolio, while for those nearing retirement, the strategy might shift to prioritize wealth preservation.

8. Make Financial Literacy a Habit

Building financial literacy empowers you to make informed decisions with confidence. There are numerous resources, from online courses to financial books and podcasts, that can help you stay informed.

Recommended Resources: Websites like Investopedia and courses on Coursera or edX cover foundational topics, while books like Rich Dad Poor Dad and podcasts such as The Dave Ramsey Show provide actionable tips and relatable examples.

Conclusion: Creating a Financial Roadmap for Lifelong Stability

Achieving financial stability is a journey, not a destination. By implementing budgeting, saving, investing, and debt management strategies, you’re building a resilient financial foundation that can support your goals and handle unexpected challenges. Start with small, consistent steps, stay informed, and adapt your strategies as life changes.

Reflect on Your Financial Health: What steps are you taking today that could strengthen your financial future? Share your thoughts in the comments or discuss with friends and family—it’s never too late or early to begin planning for financial security.

This extended guide provides a well-rounded approach to financial planning, blending actionable steps, practical examples, and relatable insights to help readers feel confident about their financial journey. Let me know if you’d like more adjustments! 😊